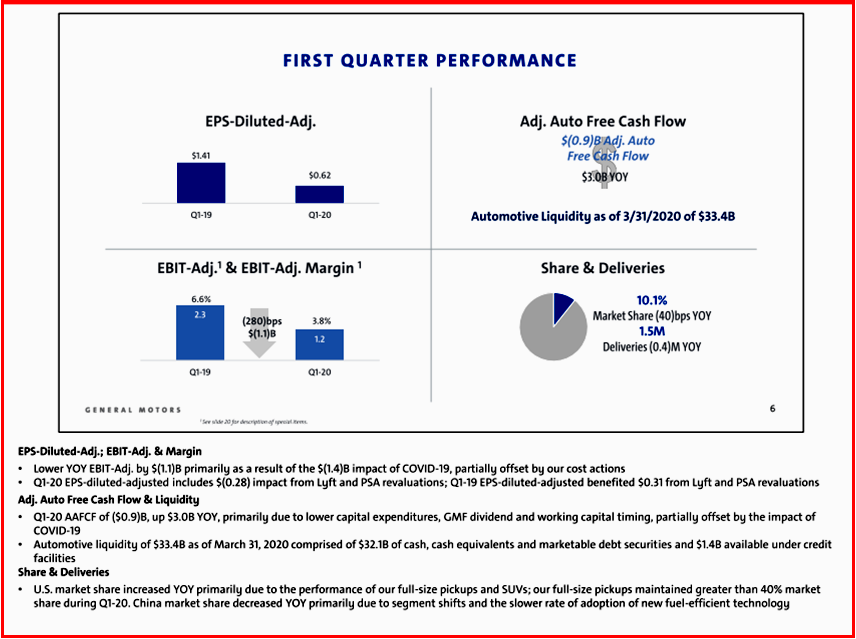

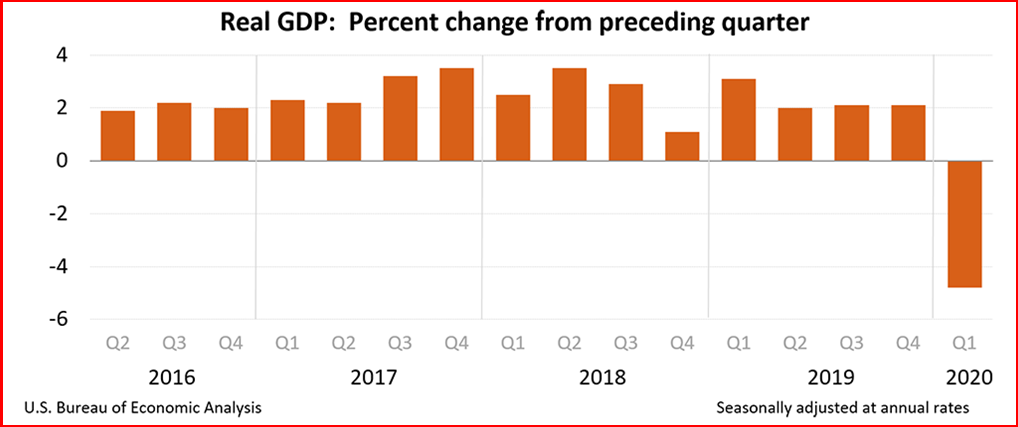

In the latest defensive move as the COVID-19 Pandemic is leading global economies into Great Depression V2.0**, General Motors (NYSE: GM) announced today it has launched an offering of senior unsecured fixed rate notes. GM intends to use the net proceeds from the sale of the notes for general corporate purposes. Translation: the cash will be needed as profits continue to drop. (COVID Effects: GM Q1 Earnings Drop -89% to $0.17 a Share)

“We expect the New 364-Day Revolving Facility to be unsecured and to provide available borrowing capacity of approximately $2 billion in U.S. Dollars only, and we have received commitments from lenders in excess of this amount. We expect the New 364-Day Revolving Facility will be generally consistent with the terms of our existing revolving credit facilities,” GM said.

Late today GM subsequently said: the pricing of three series of senior unsecured notes totallledof $4.0 billion. These notes include $1.0 billion of 5.40 percent notes due in 2023, $2.0 billion of 6.125 percent notes due in 2025 and $1.0 billion of 6.80 percent notes due in 2027. The offering is expected to settle on Tuesday, May 12, 2020. In addition, following the closing of the notes offering, GM expects to enter into a new 364-Day Revolving Credit Agreement, subject to certain closing conditions. We expect the New 364-Day Revolving Facility to be unsecured and to provide available borrowing capacity of approximately 2 billion in U.S. dollars, and we have received commitments from lenders in excess of this amount. Continue reading

Ford to Begin Phased Restart in North America 18 May

Fumbling Ford management finally voiced clear direction for the moment. Click to Enlarge.

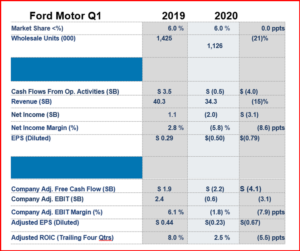

Ford is pursuing a phased restart for its North America operations beginning 18 May 18. This includes restarting vehicle production in North America and bringing back the first wave of employees that are not able to do their jobs remotely. The ramp-up will be gradual. Employees able to work remotely will continue to do so until advised. (Ford Motor Posts -$2 Billion Q1 Loss)

While Ford shut down its plants around the globe in March, cash use has remained high because production supplier payables are about 45 days. The company’s cash outflow – it is claimed – will be substantially lower after early May as Ford pays down those payables. (UAW Pressure: Ford Further Postpones NA Production Restart, Ford Motor Maxes Out Lines of Credit) Continue reading →