An auto company that plans to compete with, well, all other transitioning automakers to mobility companies. Click to Enlarge.

Volkswagen says it has now earmarked around €16 billion for investment in the future trends of e-mobility, hybridization and digitalization in a strategy that goes up to 2025. To be able to finance the sizable future investments required, it gave a presentation last week using a lot of EV hype. This was clearly designed to assure the financial markets. VW said it will systematically work on increasing its efficiency with ACCELERATE – its latest reorganization.* The targeted operating margin of at least 6% is expected to be achieved by 2023 and will be secured long term. Time and financial results will tell.

VW says it is becoming more resilient to fluctuations in the market that have pummeled it for the past couple of years. To achieve this, Volkswagen is seeking to trim its fixed costs by 5% before 2023, increase factory productivity by 5% per year, optimize material costs by 7% and bring all regions into the black in the long term. In South America and the United States, Volkswagen is trying to break even in the current fiscal year. The company says it can now post a profit in North America with a decrease in sales volumes of around 15% and in South America with sales volumes down by as much as 30%.

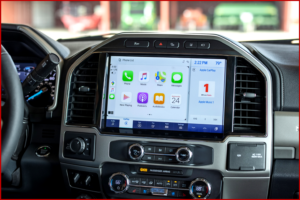

Its latest strategy says that ‘by turning the vehicle into a software-based product, Volkswagen is setting the scene for new, data-based business models aimed at lowering entry barriers to individual mobility while offering very attractive service packages for the customers. Volkswagen thus aims to generate additional revenue over the service life of the vehicle through charging and energy services, through software-based functions that customers can reserve as needed, or through automated driving.” Continue reading →

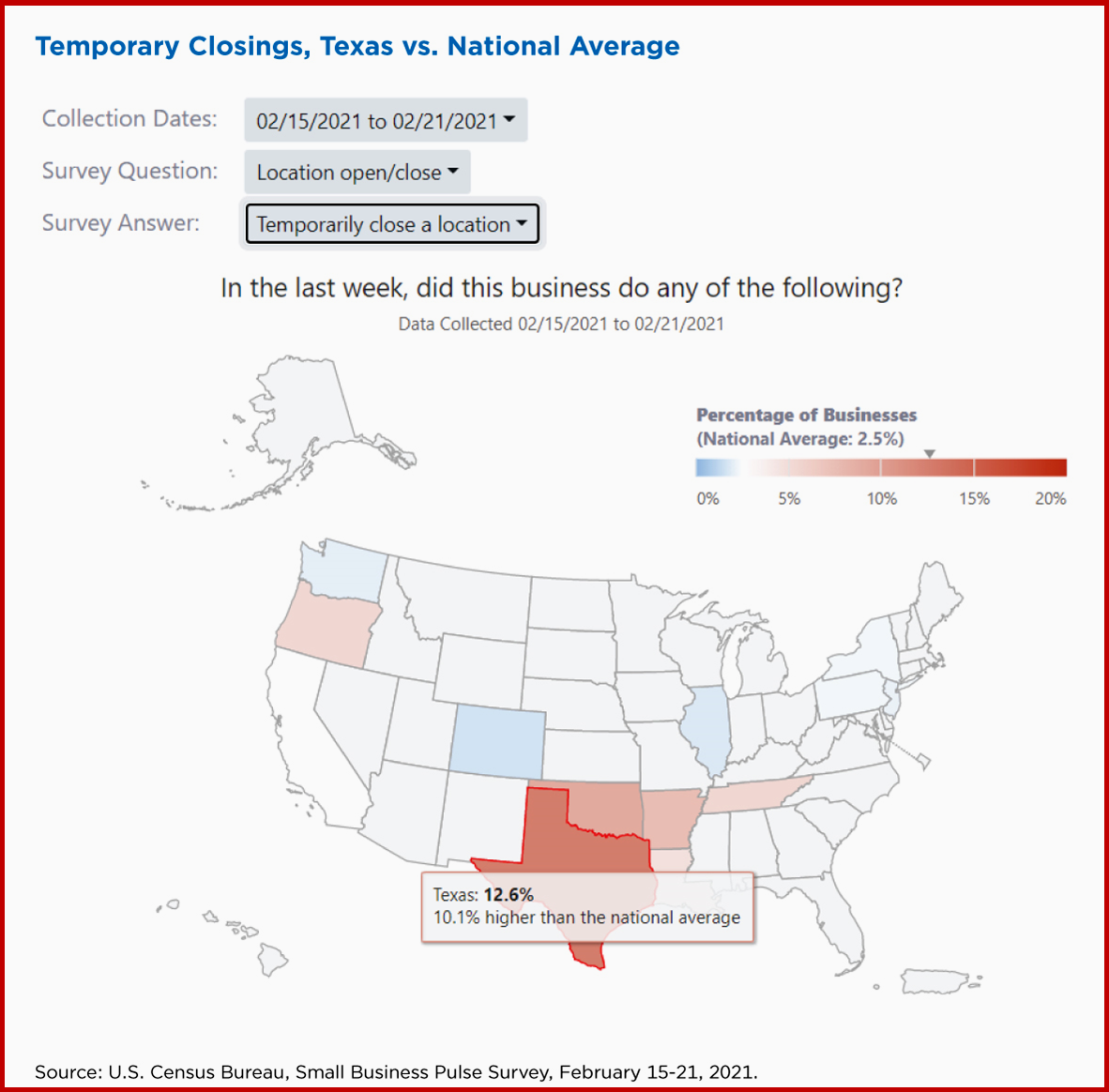

Covid Curse – EU Sales Drop 19% in February, -22% YTD

Click to Enlarge.

During February 2021, new passenger car registrations in the European Union dropped by 19.3%, as COVID containment actions, a botched vaccination program and overall uncertainty continue to negatively affect demand of a key industry.

With 771,486 units registered across the EU region, according to ACEA, this marked the lowest February total on record since 2013. All four major EU markets recorded losses last month. Italy posted the smallest drop (-12.3%), while the other markets faced stronger deterioration: Germany (-19.0%), France (-20.9%) and Spain (-38.4%). Continue reading →