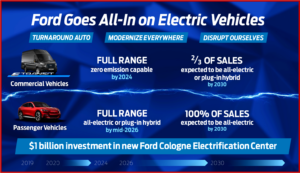

Ford Motor claims there will be a step forward in its European reorganization with a new commitment to go all-in on its electric passenger vehicles and to substantially increase and electrify its leading commercial vehicle business. By mid-2026, 100% of Ford’s passenger vehicle range in Europe will be zero-emissions capable, all-electric or plug-in hybrid, and will be completely all-electric by 2030. Ford’s entire commercial vehicle range will be zero-emissions capable, all-electric or plug-in hybrid, by 2024, with two-thirds of Ford’s commercial vehicle sales expected to be all-electric or plug-in hybrid by 2030. (See AutoInformed.com Europe’s F-Series – All-Electric Ford E-Transit Revealed, Ford – EVs Present Environmental, Human Rights Issues)

The news comes after Ford reporting, in the fourth quarter of 2020, finally, a return to profit in Europe and announced it was investing at least $22 billion globally in electrification through 2025, nearly twice the company’s previous EV investment plans. (See AutoInformed.com Ford Motor 2020 Loss $1.3 Billion. Microchip Shortage Looms) Continue reading

Groupe Renault Posts 2020 Loss of -€8.5 Billion

Pivoting the business model to tech, energy and mobility by 2025.*

Groupe Renault with sales at 2.95 million units, down -21.3%, had a net loss of -€8.5 Billion ($9.7 billion) during 2020 compared to a profit of €19 million in 2019 as Covid ravaged its results. Japanese partner Nissan – it holds a 43% share – contributed €4.9 billion of the loss. Group revenues were down -21.7% at €43.5 billion or -18.2% at constant exchange rates. Group revenues, however, were down -8.9% in total during Q3 and Q4, which if Covid ever abates provides a glimmer of a possible recovery. Another indicator – Group operating margin of -€337 million (-0.8% of revenues) was positive at €866 million (3.5% of revenues) in H2.

The disastrous results take into account an increase of charges related to restructuring costs and impairments of almost a €1 billion. Net income of -€8,046 million (-€660 million in H2) compared to €19 million in 2019. However, a negative Automotive operational free cash flow of -€4,551 million is distressing even with a positive contribution of €1,824 million in H2. Continue reading →