Click to Enlarge. Losses are below.

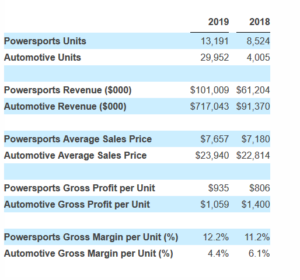

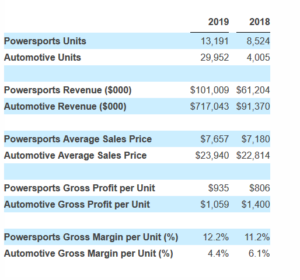

RumbleOn, Inc. (NASDAQ:RMBL), an e-commerce company, today announced operating results for the year ending 31 December 2019. The Company also provided a business update in response to the impact of the COVID-19 pandemic. Furthermore, given the uncertainty resulting from the COVID-19 pandemic, RumbleOn is withdrawing its prior 2020 financial guidance. It’s currently trading at $0.26 a share down from a 52-week high of $5.69. At 26 cents it’s overvalued in AutoInformed’s view.

Theories in business and science are often elegant, but they are subject to correction or questioning by data. The e-commerce RumbleOn touts using innovative technology to simplify how dealers and consumers buy, sell, trade or finance pre-owned vehicles. As such, it’s one of a growing number of companies that are catching analysts’ enthusiasm because they are “disruptive” to the ruling business order. Well, so is COVID-19, which is ideologically atheistic about class, party, economic theories and Wall Street. Continue reading →

Volkswagen of America’s Q1 Sales Drop -13%. March Off -42%

Volkswagen of America’s Q1 2020 sales fell 13 % to ~75,000. March sales were down 42% due to pandemic crisis. Volkswagen observed that total Jan-Feb sales were up 9.4% and the Atlas sales were up sales up 15%. In fact, SUV share of sales -Atlas and Tiguan – in Q1 2020 were 50% of the 75,075 deliveries reported.