Nissan Motor Corporation has announced financial results for the six-months ended September 30, 2022, and revised upward its full-year revenue and profit outlook for fiscal 2022. Consolidated net revenue increased by ¥715.3 billion to ¥4.66 trillion, with consolidated operating profit rising ¥17.5 billion to ¥156.6 billion, representing an operating profit margin of 3.4%. Net income (1) was ¥64.5 billion down ¥17.4 billion, from the previous year due to a one-time loss of ¥24.1 billion recorded in the second quarter because of the company’s withdrawal from the Russian market, and a decrease in equity in earnings of affiliates.

In the second quarter, free cash flow from the automobile business was a positive ¥206.6 billion. On a management pro forma basis, which includes the proportionate consolidation of results from Nissan’s joint-venture operation in China, operating profit was ¥212.6 billion, with an operating margin of 4.0%. (2)

Consistent with what other Japanese companies said during earnings week, increased revenue and operating profit were achieved despite “a severe business environment in the first half of the fiscal year, with raw material prices rising sharply and sales volume falling below the previous year’s level due to semiconductor supply shortages and the impact of COVID-related lockdowns in Shanghai, China,” Nissan said. (AutoInformed.com on Honda Posts a Profit of ¥453.4B for First Half FY Results) Continue reading →

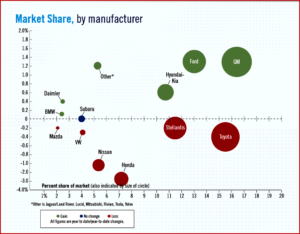

October Global Light Vehicle Sales at 7.1M Units

At 86 million units annually, October’s Global Light Vehicle (LV) selling rate was consistent with July, according to data just released by the respected LMC Automotive* consultancy. October’s meager sales of 7.1 million units was nonetheless an improvement of 10% YoY (year‐on‐year).

Year-to-date (YTD) sales are off ~1% compared to the weak covid-afflicted base of the 2021 plague. “Despite China experiencing a third consecutive month of slowing selling rates, YTD sales were up 8%. However, North America and Europe continue to struggle YTD as supply constraints hamper performances ahead of worsening macroeconomic conditions,” LMC observed. Continue reading →