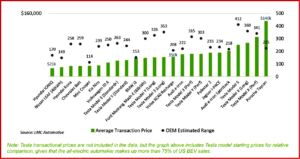

In an attempt to protect its stock from the capital markets, CEO Jim Farley will tell Deutsche Bank auto conference today that Ford anticipates adjusted EBIT to be significantly better than in second-quarter of 2020. However, net income for Q2 of 2021 is expected to be substantially lower than a year ago, when results included a $3.5 billion gain on Ford’s investment in Argo AI. Ford plans to announce second-quarter results and provide its outlook for the second half of the year on July 28.

This “follow the leader” move is the result of unfortunate timing and lingering suspicions that the future of the automotive business with automated vehicles, fuel cells and other connected car technologies will consume enormous amounts of capital that will hurt shareholders, which in the case of Ford contains numerous family members. Yesterday, GM said it will increase its EV and AV investments from 2020 through 2025 to $35 billion. This is a, gulp, 75% increase from its initial pledge announced prior to the ongoing pandemic. Continue reading

Toyota’s Woven Capital Invests in Ridecell for Mobility Services

Woven Capital* today announced that it has made an investment in Ridecell Inc., a platform powering digital transformations and Internet of Things automation for fleet-driven businesses. It is the investment arm of the Woven Planet Group, a Toyota subsidiary, which is aims to building the “safest mobility in the world.” Ridecell and the Woven Planet Group** will explore collaborative opportunities in mobility service operations.

“Ridecell is accelerating the digital transformation of a key part of the mobility industry―creating a comprehensive platform that connects fleets and automates workflow at scale,” claimed Michiko Kato, Principal, Woven Capital. Continue reading →