The Securities and Exchange Commission today announced the creation of a Climate and ESG* Task Force in the Division of Enforcement. The task force will be led by Kelly L. Gibson, the Acting Deputy Director of Enforcement, who will oversee a Division-wide effort, with 22 members drawn from the SEC’s headquarters, regional offices, and Enforcement specialized units. The Climate and ESG Task Force will develop initiatives to proactively identify ESG-related misconduct. The task force will also coordinate the effective use of Division resources, including through the use of sophisticated data analysis to mine and assess information across registrants, to identify potential violations.

What this means, in short, is that things are getting tougher for companies that are part of the global warming crisis or want to profit from investors who wish to support firms that are run on an environmentally friendly basis. Environmental, social, and governance (ESG) criteria are an “increasingly popular way for investors to evaluate companies in which they might want to invest,” said the SEC. Continue reading

Stellantis Reports Legacy FCA, PSA 2020 Financial Results

Click to Enlarge.

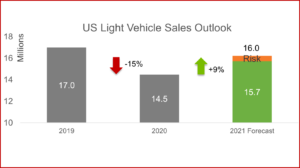

The creation of Stellantis N.V. by merging Fiat Chrysler and Peugeot occurred in January and created the world’s fourth largest automaker. It has posted financial results of the legacy operations – FCA and PSA – for the year ended December 31, 2020. Group revenue amounted to €60,734 million in 2020, down by -18.7% compared to 2019. Automotive revenue amounted to €47,613 million down by -19.2% versus 2019, mainly from the negative impact of volumes and country mix (-23.9%), the impact of exchange rates (-1.8%) and the decrease of sales to partners (-0.3%); conversely, revenues benefited from the positive effect of product mix (+4.2%) and price (+0.9%), as well as others (+1.7%).

Nonetheless, what is now Stellantis was profitable in 2020 despite COVID-19 with 7.1% Automotive adjusted operating margin at €3.4 billion. Its 9.4% H2 Automotive adjusted operating margin was a record. The net result of group share was €2.2 billion with €2.7 billion Automotive free cash flow and a €13.2 billion Automotive net financial position. Continue reading →