The flag is at half mast for the plight of the fading middle class and the millennials who will inherit the debt and the global warming crisis.

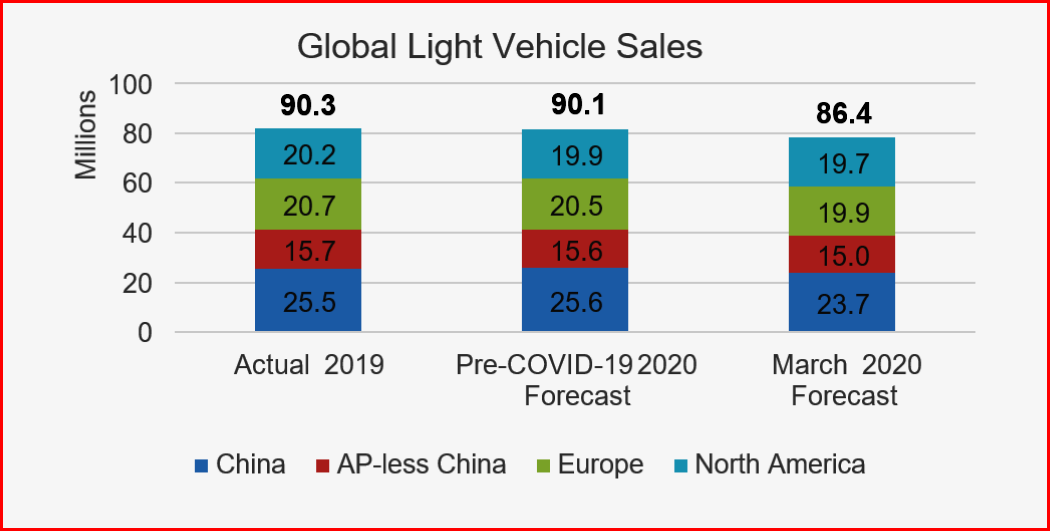

The federal budget deficit was $625 billion for the first five months of fiscal year 2020, CBO estimates. This is $80 billion more than the deficit recorded during the same period last year. Revenues and outlays alike were higher through February of this year—by 7% and 9%, respectively—than during the first five months of fiscal year 2019. The era of Trillion Dollar Deficits is now firmly in place with no end in sight. The open question is how much COVID-19, aka corona virus, will depress the world economy.

Outlays during the first five months of this year were raised slightly by shifts in the timing of certain payments that otherwise would have been due on March 1, which fell on a weekend. Those shifts increased outlays through February by $52 billion. CBO claims that without them, the outlay increase would have been 6% and the deficit for the first five months of 2020 would have been $572 billion, roughly $28 billion larger, rather than $80 billion larger, than the amount for the same period last year. This of course will all even out during the balance of the fiscal year. Continue reading →

National Debt Projections – Off the Chart Before COVID-19

Deficits keep growing under President Trump’s economic policies.

During the past decade, the federal government’s debt increased at a faster rate than at any time since the end of World War II, according to the Congressional Budget office in January. Without question our debt has outrun the economic growth over that period. At the end of 2019, federal debt was higher than at any other time since just after the war – exacerbated by Republican tax cuts for corporations and the wealthy.

Debt held by the public is a measure that indicates the extent to which federal borrowing affects the availability of private funds for other borrowers. All else being equal, an increase in government borrowing reduces the amount of money available to other borrowers, putting upward pressure on interest rates and reducing private investment. It is the measure of debt most often used by CBO in its reports on the budget. The cost of growing debt increases the finance payments of new and used vehicles. Continue reading →