BMW said today that it now owns a large majority stake in its Chinese joint-venture BMW Brilliance Automotive Ltd. with the granting of a license from the Chinese government. This allows a contract signed by the two joint-venture partners in October 2018 to become active. During the past decade, BBA has invested more than 10 billion euros in China. BMW’s larger new ownership share should add about 8 billion euros in profits at BMW this year.

BMW said today that it now owns a large majority stake in its Chinese joint-venture BMW Brilliance Automotive Ltd. with the granting of a license from the Chinese government. This allows a contract signed by the two joint-venture partners in October 2018 to become active. During the past decade, BBA has invested more than 10 billion euros in China. BMW’s larger new ownership share should add about 8 billion euros in profits at BMW this year.

BMW Group now holds 75% of the shares in BBA, while its Chinese partner, Brilliance China Automotive Holdings Ltd., indirectly holds the remaining 25%. Last year, a total of 846,237 BMW Group vehicles were delivered to customers in the Chinese market (+8.9% compared to 2020). In 2021, BBA produced more than 700,000 BMW vehicles, with around 23,000 employees. Continue reading

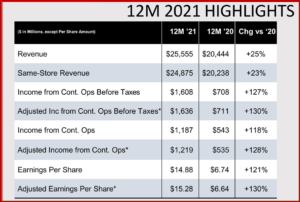

Mercedes-Benz Group Posts Some Strong 2021 Results

Mercedes-Benz says the use of standardized battery platforms and scalable vehicle architectures – with advances in battery technology – will contribute to variable cost reductions of vehicles. This of course is the business plan of all major automakers.

Mercedes-Benz Group, previously Daimler AG, today posted some positive financial results for the year 2021 based on preliminary unaudited figures. At the current point – due to various effects of the de-consolidation of the Daimler commercial vehicle business – group financials are not yet available. (AutoInformed: Daimler Truck Receives Investment Grade Ratings; Shareholders Vote to Spin-off of Daimler Truck, Rename Daimler AG to Mercedes-Benz Group)

However, the Mercedes-Benz Cars & Vans segment has exceeded the guidance range of 10-12% and now expects an adjusted Return on Sales of 12.7% in the full year. Despite the ongoing semiconductor shortages, during Q4 Mercedes-Benz Cars & Vans showed an adjusted Return on Sales of 15.0%, driven by high net pricing, good product mix and favorable used car performance. The strong profitability of the car business also translated into a solid industrial free cash flow exceeding the company guidance.

Continue reading →