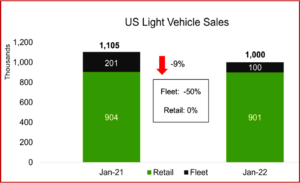

Limited inventories pulled down US sales in January to just over 1 million units, according to the LMC Automotive consultancy. This was the scrawniest January since 2014. However, the -9% YoY decline marks the smallest percentage loss since monthly sales turned negative in the summer of 2021, said LMC. (Read AutoInformed on January US New Vehicle Sales to Decline. Profits, Prices Up; NADA Predicts 2022 New-Vehicle Sales of 15.4M, up 3.4%)

The annualized selling rate, aka SAAR, improved from the average during the last six months. At 15.2 million units/year, this was the strongest SAAR since the 15.4-million-unit level in June 2021. Nevertheless, the average daily volume fell short of 42,000 units, but was consistent with the average daily volume of Q4 2021. Plus ca change… Continue reading

NADA – Light Trucks Dominating Market

Click to Enlarge.

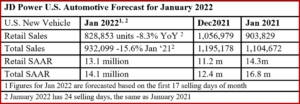

Light trucks accounted for 79.8% of all light-vehicle sales in January 2022, with pickups and SUVs gaining market share while the popular crossover segment was flat year over year, according to the National Automobile Dealers Association. After surpassing $45,000 for the first time in December 2022, the average transaction price is expected to decrease slightly, but should still be a record for the month of January.

According to J.D. Power, the average transaction price for a new light vehicle in January 2022 is expected to reach $44,905. High transaction prices continue to be supported by strong demand and very low OEM discounting. Average incentive spending per unit in January 2022 should total just $1,319, down by $2,163 from January 2021, J.D. Power says. Continued high demand for used vehicles has increased consumers’ equity in their trades. J.D. Power expects the average consumer trade-in equity to be up by 88% year over year for January 2022. Continue reading →