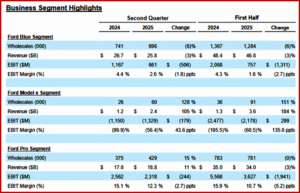

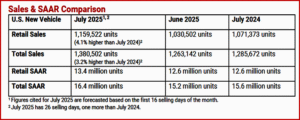

Ford Motor Company (NYSE: F) reported late yesterday its Q2 and H1 2025 financial performance. The now common internally created factors of Ford’s warranty costs,* losses on electric vehicles and the external Trump’s tariff chaos negative effects were in play. Tariffs slashed $800 million from Ford profits during Q2, the Dearborn-based company said. Its latest estimate of $2 billion in tariff costs for the year includes the impact of cost-cutting and other measures Ford is taking in response to President Trump’s trade policies. Ford Motor booked a $1.3 billion loss from repairs of vehicles under warranty, cancellation of plans to build an electric sport utility vehicle and other one-time costs. The Q2 net loss was $36 million. Ford common stock per share has been trading in the $8.44 – $11.97 range during the last year, hovering ~$11 a share recently. Its three-year return of ~5% compares to the S&P 500 at 54%.

“Our second-quarter performance shows the power of the Ford+ plan and continued execution on cost and quality,” claimed Jim Farley, Ford president and CEO. “Ford Pro is a unique competitive advantage driving both top and bottom-line growth while creating new high-margin revenue streams from software and physical services. Ford Blue ( the old internal combustion engine-based businesses) delivered profitable market share gains, and we continue to improve the efficiency of our Ford Model e (EV) business. We have scheduled an event on August 11 in Kentucky where we will share more about our plans to design and build breakthrough electric vehicles in America.” Continue reading

Magna Posts Q2 2025 EBIT of $583 Million

Click to enlarge.

Magna International (TSX: MG; NYSE: MGA) today reported relatively robust Q2 and H1 financial results in the midst of Trump’s ongoing tariff chaos and his hostility toward our Canadian friends, neighbors and business partners.*

“Our strong operating results for the second quarter of 2025 exceeded our expectations and reflect continued execution on our performance initiatives, including operational excellence, restructuring, commercial recoveries, and reduced capital and engineering spending,” said Swamy Kotagiri, Magna Chief Executive Officer. Continue reading →