Penske Automotive Group (NYSE: PAG) has announced quarterly results for the Q2 of 2025. For the quarter, revenue remained flat at $7.7 billion compared to the same period in 2024. For the quarter, revenue remained flat at $7.7 billion compared to Q2 in 2024. Net income attributable to common stockholders increased 4% to $250.0 million compared to $241.2 million in the prior year period, and related earnings per share increased 5% to $3.78 compared to $3.61 for the same period in 2024. However, PAG posted a record gross profit, which increased by 3% to $1.3 billion.

“I am pleased with the performance of our diversified international transportation services business in the second quarter. The second quarter represented the third consecutive quarter of year-over-year earnings growth driven by an overall gross margin increase of 50 basis points, an increase of 50 basis points in retail automotive service and parts gross margin, and a 30-basis point improvement in selling, general and administrative expenses as a percentage of gross profit,” said Chair Roger Penske. Continue reading

Ford Says Trump Tariffs Will Slash Earnings by $2B

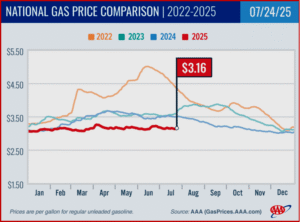

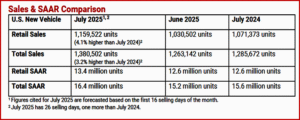

Click to enlarge.

Ford Motor Company (NYSE: F) reported late yesterday its Q2 and H1 2025 financial performance. The now common internally created factors of Ford’s warranty costs,* losses on electric vehicles and the external Trump’s tariff chaos negative effects were in play. Tariffs slashed $800 million from Ford profits during Q2, the Dearborn-based company said. Its latest estimate of $2 billion in tariff costs for the year includes the impact of cost-cutting and other measures Ford is taking in response to President Trump’s trade policies. Ford Motor booked a $1.3 billion loss from repairs of vehicles under warranty, cancellation of plans to build an electric sport utility vehicle and other one-time costs. The Q2 net loss was $36 million. Ford common stock per share has been trading in the $8.44 – $11.97 range during the last year, hovering ~$11 a share recently. Its three-year return of ~5% compares to the S&P 500 at 54%.

“Our second-quarter performance shows the power of the Ford+ plan and continued execution on cost and quality,” claimed Jim Farley, Ford president and CEO. “Ford Pro is a unique competitive advantage driving both top and bottom-line growth while creating new high-margin revenue streams from software and physical services. Ford Blue ( the old internal combustion engine-based businesses) delivered profitable market share gains, and we continue to improve the efficiency of our Ford Model e (EV) business. We have scheduled an event on August 11 in Kentucky where we will share more about our plans to design and build breakthrough electric vehicles in America.” Continue reading →