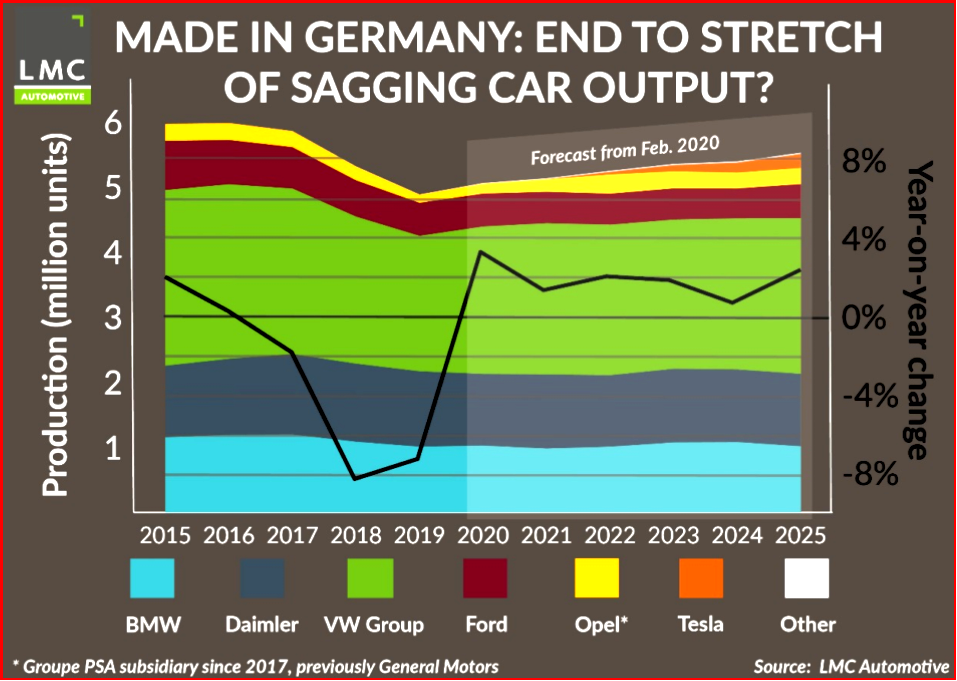

The CFO of Mercedes-Benz AG, Frank Lindenberg, will leave Daimler and on 31 March 2020 under a sweeping reorganization announced this week in Stuttgart. It’s just the latest example of the changes that are being made industry-wide as old-line automakers confront the capital and profit destroying aspects of the rapidly emergence of 21st century autonomous and connected vehicles.

The CFO of Mercedes-Benz AG, Frank Lindenberg, will leave Daimler and on 31 March 2020 under a sweeping reorganization announced this week in Stuttgart. It’s just the latest example of the changes that are being made industry-wide as old-line automakers confront the capital and profit destroying aspects of the rapidly emergence of 21st century autonomous and connected vehicles.

Compounding the problem is that governments will now dictate the designs of vehicles. As part of the so-called Ambition 2039 sustainability offensive, Mercedes-Benz AG plans to make its entire new car product portfolio CO2-neutral. Shorter reporting lines in the new structure will help in this effort, it’s hoped. (BMW Group and Daimler Mobility Hoping to Profit on Joint Ventures. Monetizing a Monopoly or a Joint Survival Bid?, Capital Punishment Day for Auto Workers at Daimler) Continue reading

Wells Fargo to Pay $500 Million for Misleading Investors

The Securities and Exchange Commission today charged California-based Wells Fargo & Co. for misleading investors about the success of its business strategy at a time when it was opening fake accounts for unknowing customers and selling unnecessary products that went unused. The SEC’s order finds that Wells Fargo violated the anti-fraud provisions of the Securities Exchange Act of 1934.

Wells Fargo has agreed to pay $500 million to settle the charges, which will be returned to investors. The $500 million payment is part of a combined $3 billion settlement with the SEC and the Department of Justice.

Continue reading →