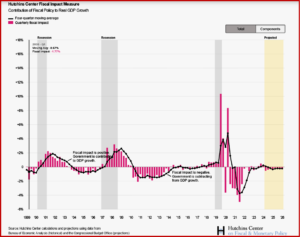

Fiscal policy increased U.S. GDP growth by 0.3 percentage point in the fourth quarter of 2024, the Hutchins Center Fiscal Impact Measure (FIM)* released today shows. The FIM translates changes in taxes and spending at federal, state, and local levels into changes in aggregate demand, showing the effect of fiscal policy on real GDP growth. GDP increased at an annual rate of 2.3% in the fourth quarter of 2024, according to the government’s latest estimate. The 0.3 percentage point increase in the fourth quarter was largely the result of slightly stimulative taxes and transfers.

“We expect the FIM to turn negative in the next quarter and remain so through the end of our forecast period (the fourth quarter of 2026), largely driven by weak growth in federal and state purchases and only partially offset by strong growth in net transfers. Continue reading

Acura MDX Vehicles recalled for Bad Rear-view Cameras

American Honda Motor Company is (7267.T) recalling more than 9000 2025 Acura MDX vehicles for bad back-up cameras, according to a safety defect filing made public by the National Highway Traffic Safety Administration this morning.

“The touchscreen in the center console may go blank, resulting in the rearview camera image not displaying as intended. As such, these vehicles fail to comply with the requirements of Federal Motor Vehicle Safety Standard (FMVSS) number 111, Rear Visibility,” Honda said in the mandatory safety defect recall filing. Continue reading →