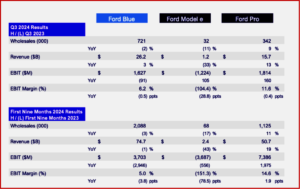

Ford Motor Company (NYSE: F) posted Q3 2024 of $46 billion; net income of $0.9 billion, including a previously announced $1 billion electric vehicle-related charge, as well as an adjusted EBIT of $2.6 billion. It’s stock is off ~9% in trading today. Cash flow from operations in Q3 was $5.5 billion, and adjusted free cash flow was $3.2 billion. At quarter-end, Ford had nearly $28 billion in cash and $46 billion in liquidity. It’s going to need it: Ford’s profit margin was razor-blade thin at 1.9%. Perhaps worse, full-year 2024 adjusted EBIT is now forecast at ~$10 billion. Nonetheless, Ford declared fourth-quarter regular dividend of 15 cents per share. Head hunters are also on the street looking for a new chief of staff.

“We are in a strong position with Ford+ as our industry undergoes a sweeping transformation,” claimed Ford President and CEO Jim Farley. “We have made strategic decisions and taken the tough actions to create advantages for Ford versus the competition in key areas like Ford Pro, international operations, software and next-generation electric vehicles. Importantly, over time, we have significant financial upside as we bend the curve on cost and quality, a key focus of our team.” Continue reading

Penske Automotive Group Q3 2024 Net Income Drops

Click to enlarge.

Penske Automotive Group, Inc. (NYSE: PAG), yesterday announced quarterly results for Q3 of 2024. Q3 revenue increased 2% from the third quarter of 2023 to $7.6 billion. Net income attributable to common stockholders was $226.1 million compared to $263.4 million in the prior year period, and related earnings per share was $3.39 compared to $3.92 for the same period in 2023. Foreign currency exchange positively impacted revenue by $69.0 million, net income attributable to common stockholders by $1.7 million, and earnings per share by $0.03. (read AutoInformed on Penske Automotive Group Posts Lukewarm Q2 Results)

“I am pleased with our financial performance during the third quarter, despite the impact from the stop sale of certain vehicles and the residual impact from the CDK Cyber Security incident. New and used retail automotive gross profit per unit remained strong, retail automotive service and parts performed at record levels, the retail commercial truck business performed well, selling, general, and administrative expenses remained well controlled, and the equity income from Penske Transportation Solutions increased 14% sequentially despite continued freight challenges,” said Chair and CEO Roger Penske. Continue reading →