The U.S. Department of Energy (DOE), through its Loan Programs Office (LPO), announced today the closing of a $162.4 million loan guarantee to LongPath Technologies, Inc. (LongPath). The loan guarantee, sustained by President Biden’s Inflation Reduction Act, will help finance the construction and installation of more than 1000 remote monitoring towers as part of a real-time methane emissions monitoring network. The network will include sites in every major U.S. oil and gas production region, including those in California, Colorado, New Mexico, North Dakota, Oklahoma, Pennsylvania, Texas, and Wyoming. LongPath’s Active Emissions Overwatch System project aims to deploy large-area remote methane monitors to provide emissions detection, location, and quantification services for tens of thousands of oil and gas sites.

“Preventing harmful greenhouse emissions from entering our atmosphere is a key pillar of President Biden and Vice President Harris’ Investing in America agenda to improve public health while combatting climate change,” said U.S. Secretary of Energy Jennifer M. Granholm. “Today’s announcement underscores the Biden-Harris Administration’s continued efforts to create environmentally resilient communities and ensure the United States leads the world in deploying next-generation clean energy solutions.” Continue reading →

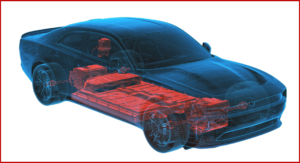

Ford Posts Weak Q3 Results. Stock Dropping on Cut Outlook

Click to enlarge.

Ford Motor Company (NYSE: F) posted Q3 2024 of $46 billion; net income of $0.9 billion, including a previously announced $1 billion electric vehicle-related charge, as well as an adjusted EBIT of $2.6 billion. It’s stock is off ~9% in trading today. Cash flow from operations in Q3 was $5.5 billion, and adjusted free cash flow was $3.2 billion. At quarter-end, Ford had nearly $28 billion in cash and $46 billion in liquidity. It’s going to need it: Ford’s profit margin was razor-blade thin at 1.9%. Perhaps worse, full-year 2024 adjusted EBIT is now forecast at ~$10 billion. Nonetheless, Ford declared fourth-quarter regular dividend of 15 cents per share. Head hunters are also on the street looking for a new chief of staff.

“We are in a strong position with Ford+ as our industry undergoes a sweeping transformation,” claimed Ford President and CEO Jim Farley. “We have made strategic decisions and taken the tough actions to create advantages for Ford versus the competition in key areas like Ford Pro, international operations, software and next-generation electric vehicles. Importantly, over time, we have significant financial upside as we bend the curve on cost and quality, a key focus of our team.” Continue reading →