Too little, too late?

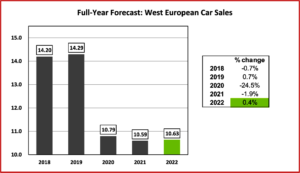

At its first digital ESG (Environment, Social and Governance) Conference for investors and analysts, Mercedes-Benz announced actions aimed at cutting CO2 emissions while creating value for all stakeholders. “The shift towards climate neutrality is changing the financial world and green financing is gaining in importance. Therefore, the variety of green financing instruments like Green ABS and green KPI-linked bilateral funding agreements will be increased. Mercedes-Benz also expects a significant increase in EU taxonomy aligned CapEx until 2026 in accordance with its all-electric strategy,” said Mercedes. As promised at the COP26 UN Climate Change Conference* in November 2021, Mercedes-Benz wants a faster transition to electric cars. The question facing all major automakers is whether this it too little to late to stop the extreme weather, property destruction, social disruptions and perhaps extinction of people inhabiting planet earth.

The German auto industry is currently under heavy criticism for its lobbying the German government to not impose sanctions on the use of Russian or other fossil fuels, saying it can’t be done. However, the latest UN report – IPCC’s Sixth Assessment Report (AR6) – says: “The application of diverse policy instruments for mitigation at the national and sub-national levels has grown consistently across a range of sectors By 2020, over 20% of global GHG emissions were covered by carbon taxes or emissions trading systems, although coverage and prices have been insufficient to achieve deep reductions. By 2020, there were ‘direct’ climate laws focused primarily on GHG reductions in 56 countries covering 53% of global emissions. Policy coverage remains limited for emissions from agriculture and the production of industrial materials and feedstocks.” Continue reading →

Today Nissan announced the acquisition of the e.dams race team, thereby taking full ownership of its involvement in the ABB FIA Formula E World Championship. The team is currently based in Le Mans, France, and will continue to race as planned in Season 8. The change in ownership and new management structure will take place with immediate effect. Tommaso Volpe, general manager Nissan Formula E, will also become managing director at e.dams.

Today Nissan announced the acquisition of the e.dams race team, thereby taking full ownership of its involvement in the ABB FIA Formula E World Championship. The team is currently based in Le Mans, France, and will continue to race as planned in Season 8. The change in ownership and new management structure will take place with immediate effect. Tommaso Volpe, general manager Nissan Formula E, will also become managing director at e.dams.

Stellantis to Consolidate Financial Services in China

Stellantis has costly plans for 75 new EV models.

Stellantis N.V. (NYSE: MTA – Euronext Paris: STLA) said today that intends to consolidate its auto financial services in China into a Stellantis wholly owned Auto Finance Company (AFC). The latest move comes after the restructuring of financial services in Europe and the United States. It is in keeping with its “asset light business model” developed in part given the extremely high cost of converting to electric and autonomous vehicles in what has become a global race for survival. Stellantis has plans for 75 new EV models by 2030. (AutoInformed on: Stellantis Consolidates Financial Services for All Brands, Dare Forward 2030 – Stellantis Survival Plan Unveiled )

Stellantis now says PSA Finance Nederland (PFN), a fully-owned financing subsidiary of BPF (Banque PSA Finance) and DPCA have entered into an equity transfer agreement with Dongfeng Group, whereby their respective shares in the JV Dongfeng Peugeot Citroen Auto Finance Company (DPCAFC is the 15-year-old auto finance joint venture between Stellantis, DPCA and Dongfeng Group) will be sold to Dongfeng Group, subject to regulatory approval. Continue reading →