GM Software Automation Engineer Daniel Heintzel works with a telematics robot at the Infotainment Lab.

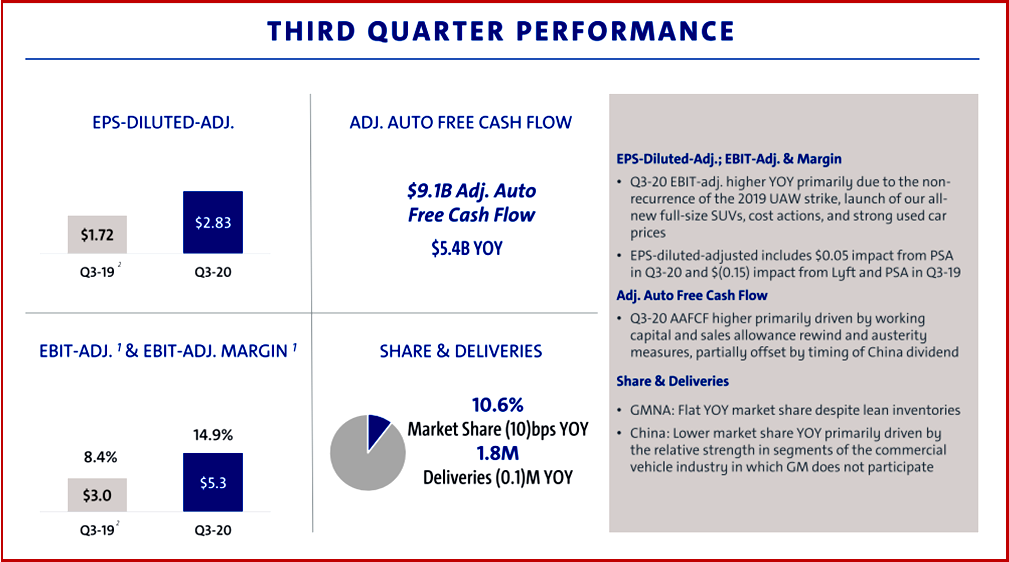

General Motors says it will hire 3,000 new employees in engineering, design and IT to help product development and ‘software as a service’ activities. The positions in engineering, IT and design will contribute to GM’s EV and “customer experience” priorities. GM will also offer more remote opportunities than ever as development of autonomous and electric vehicles and advanced platforms like the Ultium battery system continue. GM claims that recent virtual development innovations made by the company’s engineering team have allowed GM to speed up the product timelines of upcoming EVs while keeping costs low.

“As we evolve and expand our software expertise and services, it’s important that we continue to recruit and add diverse talent,” said GM President Mark Reuss. “This will clearly show that we’re committed to further developing the software we need to lead in EVs, enhance the customer experience and become a software expertise-driven workforce.” Continue reading

SMMT – Final Plea for Zero-Tariff Trade Deal As Brexit Negotiations Near End

Click to Enlarge.

The UK automotive industry has issued a last-chance plea for a zero-tariff, zero-quota trade deal as Brexit negotiations enter the endgame this week. The call comes as a new survey from the Society of Motor Manufacturers and Traders (SMMT) reveals the cost to the sector of preparing for Brexit has surpassed £735 million, with more than £235 million spent in 2020 alone. (Brexit – UK Car Production Declines -10.6%. Exports Hit, No Deal Brexit to Cost UK Auto Sector £9 Billion Per Year, Brexit Panic Takes Hold. Auto Industry Urges – Begs? – Negotiators to Avert the Business Killing Worst-Case Scenario, Brexit Automaker Winners, Losers – Predictable and Surprising, Doomsday? No-Deal Brexit Impact on UK Light Vehicle Market)

Most companies (67%) across the industry say they are doing everything in their control to prepare for new processes that will come into play on 1 January, with 70% securing GB Economic Operators Registration and Identification (EORI) numbers, 60% spending significantly on stockpiling and 52% employing customs agents, as companies also try to prepare for any disruption or delay to supply chains.

However, significant gaps in the industry’s ability to plan still exist, with a lack of clarity on the nature of the UK-EU’s future relationship hampering the efforts of almost nine out of 10 (86%) firms to prepare. A disastrous ‘no deal’ outcome, or failure to achieve workable deal for auto, would mean £47 billion hit to UK sector over next five years – on top of ongoing coronavirus crisis costs, the auto industry claims. Ah, such is the price of blind ideologies who ignore real consequences, economists and political scientists. Continue reading →