The certification test that the FAW J7+ automated truck passed was based on China’s highway and transportation standards.

China’s first autonomous truck, FAW J7+, passed the national certification test at the China Automotive Technology & Research Center (CATARC). The FAW J7+ has met all key safety and performance metrics to start on-road operation. This is China’s first independent certification of an automated truck, an important milestone for the commercialization of automated heavy-duty trucks in China. It is expected to enter production during the first half of 2021. It used Plus self-driving technology.*

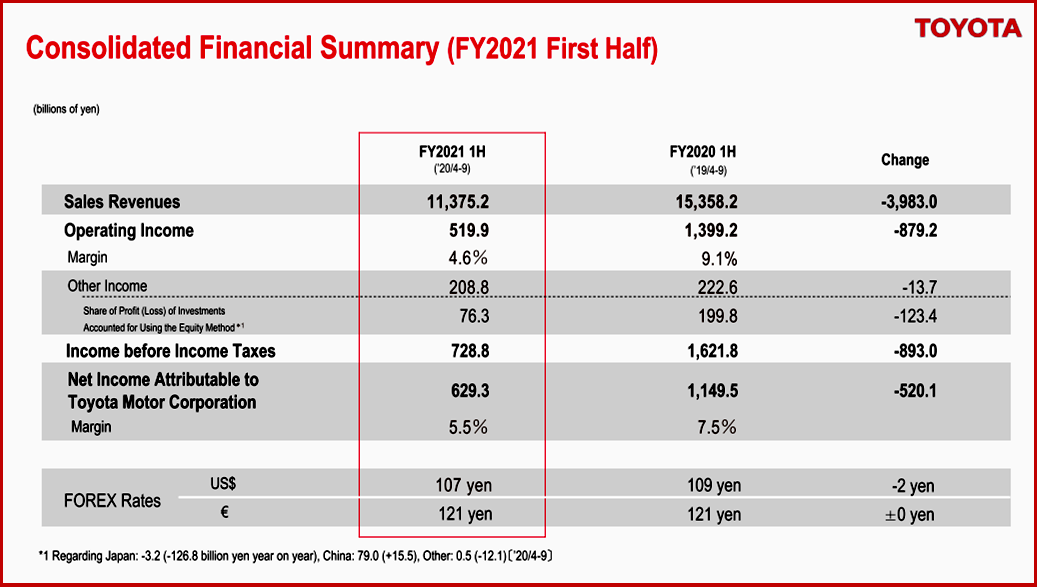

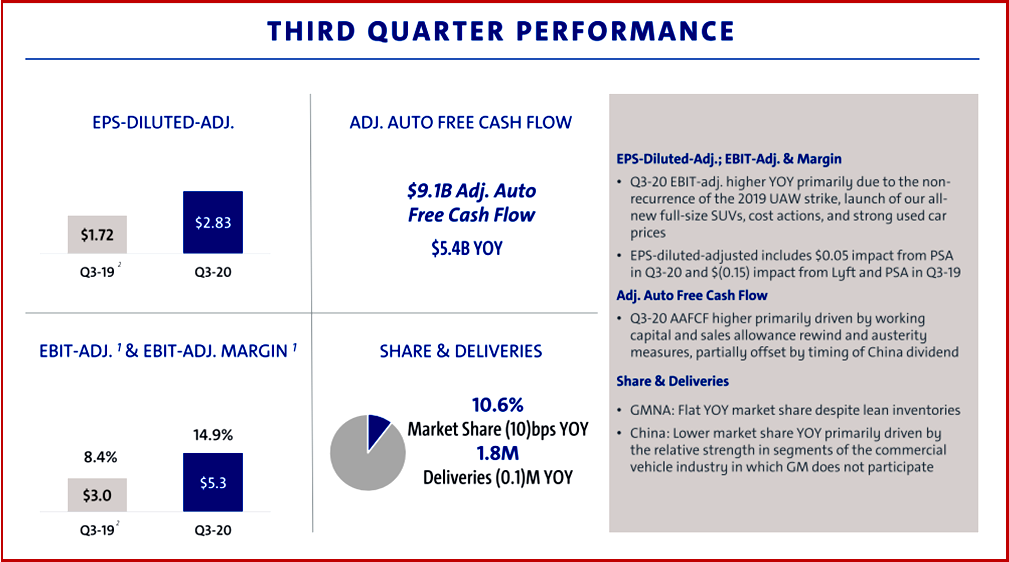

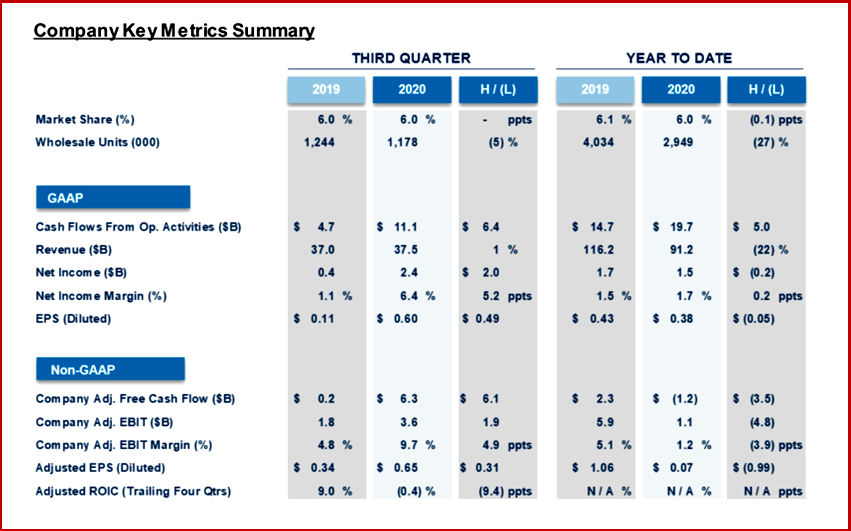

Autonomous trucks or commercial vehicles are poised to become a global battleground among makers since it is a more expansive road to profitable products than autonomous cars. Nonetheless, the technology is daunting and just as expensive, but it can be transferred to anything mobile. An announcement from General Motors on autonomous trucks is expected at anytime now as it is in talks with talks with startup called Nikola Corp. about a partnership to make electric and fuel-cell-powered trucks. GM is well along in its own autonomous vehicle driving technology and electrification and plans to begin testing unmanned autonomous vehicles by the end of this year in San Francisco. (GM Earns $5.3B in Q3 – Trucks, China Help)

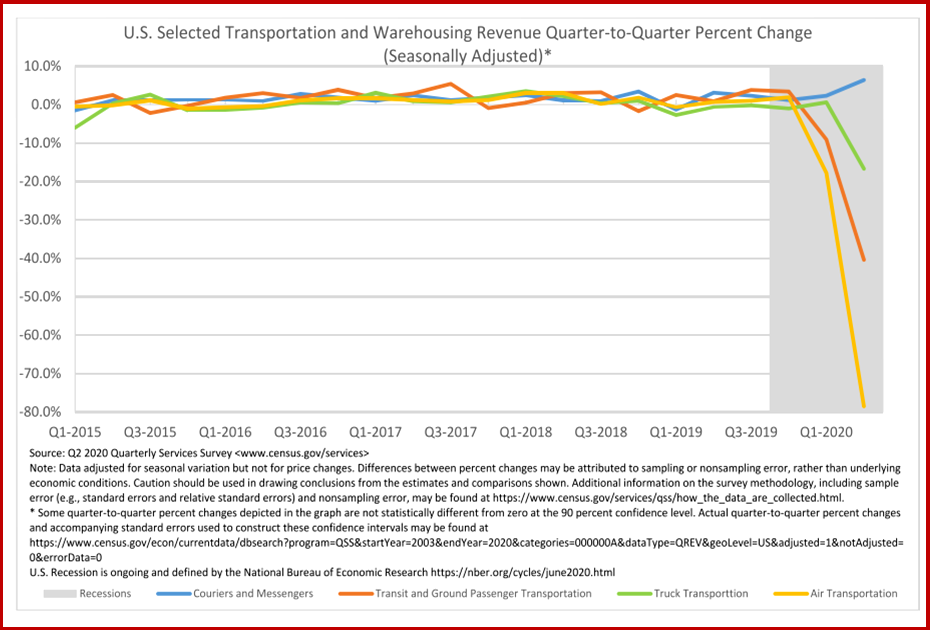

China with its own vast market and a Communist central government that can quickly decree and implement policy – think Covid response or Trump’s defeat in the trade war he started – would seem to have an advantage here. It is lucky for western automakers that Chinese industrial policy allowed them to operate there but only with local partners. How the pie is sliced outside of China when and if the exports become voluminous will be subject to much behind the scenes maneuvering and uncomfortable board meetings. (Covid Causalities: US Trade Deficit Continues to Increase) Continue reading

Debt to Watch as Covid Spreads – New FCA Bank Notes

FCA Bank* acting through its Irish Branch successfully priced today a Euro 850 million offering of unsecured senior debt securities due November 2023, with a fixed rate coupon set at 0.125%. This issuance represents the lowest ever coupon for FCA Bank in the Eurobond market, with an order book of over Euro 5 billion from 277 investors. This issuance, the third one in 2020, falling just a couple of months after the September 2020 trade, accelerates the execution of the 2021 refinancing plan and “further strengthens the group’s funding position, confirming the investors’ confidence in FCA Bank.”

It also deftly sidesteps the consequences of conservative Boris Johnson’s government and the Brexit madness that will isolate the British economy and perhaps see a return to the Irish people of the IRA plague of violence that the Good Friday agreement ended. This nightmare of political violence also present in the US, reappeared last August when a cleanup of the paramilitary New Irish Republican Army led to arrests on terrorism-related charges and serious rioting. If Brexit talks fail, more is likely to follow, and the membership of the New IRA and other groups could grow. Continue reading →