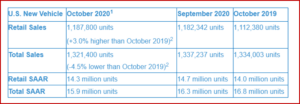

New-vehicle U.S. retail sales for the month of October are projected to be up from October 2019, according to a joint forecast from J.D. Power and LMC Automotive. Retail sales for new vehicles are anticipated to reach 1,187,800 units, a 3.0% increase compared with October 2019 when adjusted for selling days. October 2020 contains one additional selling day over October 2019. Comparing the same sales volume without adjusting for the number of selling days is an increase of 6.8% year-over-year – if the forecast holds true as Covid continues increasing its deadly grip on people and the U.S. economy. Global light-vehicle sales year to date through September increased three percentage points from August and are now down -19% from the same period in 2019.

Complete U.S. new-vehicle sales including all transactions for October are projected to reach 1,321,400 units, a -4.5% decrease from October 2019 when adjusted for selling days. The seasonally adjusted annualized rate, aka SAAR, for total new vehicle sales is expected to be 15.9 million units, down 0.8 million units from 2019, the least year-over-year decline since the pandemic began. This is the annual output of two to four final assembly plants, without considering the component parts plants from internal or external sources. Continue reading

Ford Q3 Net Income at $2.4B Treads Water. Q4 $500M Loss?

“We haven’t suddenly fixed the issues in our automotive business…

Ford Motor Company posted modest Q3 results after the market closed yesterday that continued to reflect the underlying weakness of the business compounded by ongoing negative effects of the Covid pandemic. The positives in Q3 – $2.4 billion in net income and 6.4% net income margin, on revenue of $37.5 billion were also areas of potential negatives in Q4 as Covid reappears in North America.

As a result, the Ford outlook is wobbly including a fourth quarter adjusted EBIT between break-even and a, gulp, $500 million loss. (Ford Pickup Truck Sales Best Q3 in 15 Years. Cars Dead, Ford Motor Q2- Sales Drop -53%. Debt Grows $10B, Ford Motor US Sales Down in -3% 2019 as War Worries Increase, 2019 Ford Motor US Sales Continue Slump, Ford Motor 2019 Q2 – Sales, Share, Net Income, EPS All down, Ford Motor 2018 US Sales drop -3.5% to 2.5 Million. Cars at 486,000 dive -18%. Trucks Up Again)

“We haven’t suddenly fixed the issues in our automotive business, but we have a clear turnaround plan to get that done,” said Jim Farley, Ford’s president and CEO. “That work is underway and we’re making progress.” Continue reading →