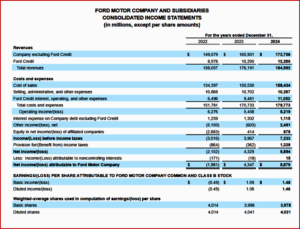

Ford Motor Company (NYSE: F) today posted Q4 full-year 2024 financial results. They were mixed from awful to okay. During 2024, Ford Blue’s revenue was flat at $101.9 billion as positive net pricing offset a 2% decline in wholesale vehicle transactions from what Ford said were the cancellation of low-margin products. The internal combustion engine segment at Ford’s earnings before taxes (EBIT) was $5.3 billion. Ford ModeE reported a full-year EBIT loss of $5.1 billion. The electric vehicle e segment delivered $1.4 billion in cost improvements, net of a $100 million increase in spending to launch new battery plants and next-generation electric vehicles, Ford said. For full-year 2024, revenue climbed 5% to $185 billion; net income was $5.9 billion, and adjusted EBIT was $10.2 billion. For 2025 Ford is predicting a $2 billion profit drop! Bloomberg says that 27% of analysts have a sell recommendation, the highest on record. (read AutoInformed.com on Ford Motor Shuffles Leadership Amid Trump Chaos and Ford Motor Posts 2023 Net Income of $4.3 Billion)

“Ford is becoming a fundamentally stronger company. We finished 2024 with a solid fourth quarter, capping the highest revenue year in Ford’s history,” said President and CEO Jim Farley. “Our product portfolio offers the broadest powertrain choice. And Ford Pro, with its mid-teen margins, leading market position, and growing service and repair revenue, provides unique advantages for continued growth. In 2025, we expect to make significantly more progress on our two biggest areas of opportunity – quality and cost – as we enter the heart of our Ford+ transformation. We control those key profit drivers, and I am confident that we are on the right path to create long-term value for all our stakeholders,” Farley claimed.* Continue reading

Volvo Cars Posts Record Sales, Revenue, Profits in 2024, but…

Click to enlarge.

Volvo Cars (VOLCAR B:STO)* today posted a record-breaking year in 2024 with the highest full-year retail sales, revenues and core operating profit in its 98-year history. However, the Chinese owned company anticipates a turbulent 2025 “due to challenging market conditions,” aka Trump’s Trade and Tariff Wars.** “Full-year revenues exceeded SEK 400 billion for the first time in the company’s history, due to a new all-time sales record of 763,389 cars. Its full-year core operating profit of SEK 27 billion, excluding joint ventures and associates, was another record and up 6% compared to 2023. The core operating margin came in at 6.8%, up from 6.4% in 2023,” Volvo said.

“2024 was a year of two halves,” said Jim Rowan, chief executive for Volvo Cars. “For the first six months, we recorded strong double-digit volume growth. But like the rest of the industry, we experienced a more challenging second half. Demand slowed down and this had an impact on both our sales pace and underlying profitability.” Continue reading →