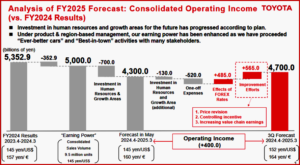

Toyota Motor Corporation (TMC: Tokyo 7203. NYSE: TM) today announced financial results for the third quarter fiscal year 2025, which ended 31 December 2024. TMC also announced significant changes in China. Consolidated vehicle sales totaled ~7,000,000 units, a decrease of ~295,000 units compared to the same period fiscal year 2024. On a consolidated basis, net revenues for the period totaled 35.673 trillion yen ($233.2 billion), an increase of 4.9%. Operating income decreased from 4.240 trillion yen ($29.7 billion) to 3.679 trillion yen ($24.0 billion), while income before income taxes [footnote 1] was 5.430 trillion yen ($35.5 billion). Net income [footnote 2] increased from 3.947 trillion yen ($27.6 billion) to 4.100 trillion yen ($26.8 billion).{see AutoInformed.com on Toyota Motor FY2025 Q2 Earnings Down Significantly}*

“As a symbol of Toyota’s uniqueness, we have been honing product-and region-based management. As we are striving the activity this fiscal year also, I feel that we will be able to further enhance our earning power,” said Chief Financial Officer Yoichi Miyazaki. “The transformation into a mobility company is something we believe can be built by repeatedly taking on challenges together with partners who share the same aspirations.” Continue reading

Ford Motor Posts Mixed Results for 2024

Click for more.

Ford Motor Company (NYSE: F) today posted Q4 full-year 2024 financial results. They were mixed from awful to okay. During 2024, Ford Blue’s revenue was flat at $101.9 billion as positive net pricing offset a 2% decline in wholesale vehicle transactions from what Ford said were the cancellation of low-margin products. The internal combustion engine segment at Ford’s earnings before taxes (EBIT) was $5.3 billion. Ford ModeE reported a full-year EBIT loss of $5.1 billion. The electric vehicle e segment delivered $1.4 billion in cost improvements, net of a $100 million increase in spending to launch new battery plants and next-generation electric vehicles, Ford said. For full-year 2024, revenue climbed 5% to $185 billion; net income was $5.9 billion, and adjusted EBIT was $10.2 billion. For 2025 Ford is predicting a $2 billion profit drop! Bloomberg says that 27% of analysts have a sell recommendation, the highest on record. (read AutoInformed.com on Ford Motor Shuffles Leadership Amid Trump Chaos and Ford Motor Posts 2023 Net Income of $4.3 Billion)

“Ford is becoming a fundamentally stronger company. We finished 2024 with a solid fourth quarter, capping the highest revenue year in Ford’s history,” said President and CEO Jim Farley. “Our product portfolio offers the broadest powertrain choice. And Ford Pro, with its mid-teen margins, leading market position, and growing service and repair revenue, provides unique advantages for continued growth. In 2025, we expect to make significantly more progress on our two biggest areas of opportunity – quality and cost – as we enter the heart of our Ford+ transformation. We control those key profit drivers, and I am confident that we are on the right path to create long-term value for all our stakeholders,” Farley claimed.* Continue reading →