Stellantis** (NYSE: STLA) and Samsung SDI* today announced that they have signed a memorandum of understanding to establish a second battery manufacturing plant in the United States under the existing StarPlus Energy joint venture. Scheduled to start production in 2027, an initial annual production capacity of 34 gigawatt hours (GWh) is forecast.

In May 2022, Stellantis and Samsung SDI announced their intention to build a first battery manufacturing facility in Kokomo, Indiana. Targeted to launch in Q1 of 2025, the plant will have an annual production of 33 GWh, up from the initial target of 23 GWh. That plant – now plants – are a source of contention with the UAW, which is currently conducting contract negotiations with Stellantis. (AutoInformed on Stellantis and Samsung SDI JV to Build EV Batteries in Kokomo and UAW Dumps Traditional Negotiation Opening Handshake) Continue reading

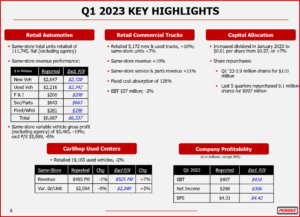

GM Posts Strong Q2 Results with $3.2B in Earnings

General Motors (NYSE: GM) today reported strong second-quarter 2023 revenue of $44.7 billion, net income attributable to stockholders of $2.6 billion and earnings [EBIT-adjusted] of $3.2 billion. GM delivered 1.4 million vehicles during Q2, many of them in premium truck and SUV segments. In the US, the Q2 Average Transaction Price (ATP) was $52,248, up $1890 Year-over-Year and $1600 compared to Q1 2023.

“The biggest driving force behind our financial results is customer demand for our vehicles, which have now led the U.S. industry in initial quality for two consecutive years. We have earned four consecutive quarters of higher retail market share in the U.S. versus a year ago with continued strong pricing and incentive discipline, we’re leading in both commercial and total fleet deliveries calendar year to date, and we’re growing profitably in international markets such as Brazil and Korea,” said CEO Mary Barra. Continue reading →