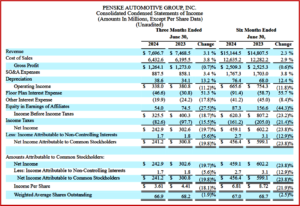

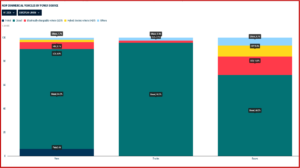

Penske Automotive Group (NYSE: PAG) today posted $7.7 Billion in revenue during Q2 2024, a quarterly record. Q2 included a 10% increase in quarterly retail automotive service and parts revenue to $753 million, which is also a quarterly record. However, net income attributable to common stockholders was $241.2 million compared to $300.8 million in the prior year period, and related earnings per share was $3.61 compared to $4.41 for the same period in 2023. Foreign currency exchange negatively impacted revenue by $0.8 million, net income attributable to common stockholders by $0.4 million, but had no negative effect on earnings per share.

“I am pleased to see that our service and parts business remains strong and contributed to our record total quarterly revenue of $7.7 billion. In addition, our focus on efficiency and controlling costs drove a sequential decline in selling, general, and administrative expenses as a percentage of gross profit by 50 basis points to 70.2%,” said Chair and CEO Roger Penske, which is more or less what he said about Q1 results. Continue reading

Stellantis Pursuing Share Buy Backs?

Click for more.

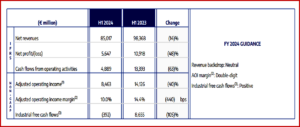

Stellantis N.V. (NYSE: STLA) said today that pursuant to its Share Buyback Program* announced on 15 February 2024, covering up to €3 billion to be executed in the open market, it has signed a share buyback agreement for the third tranche of its Program with an investment firm that will make its trading decisions concerning the timing of purchases independently of Stellantis. This despite (or because of?) its dreadful performance thus far in 2024. (read AutoInformed.com on: Stellantis Tanks in First Half of 2024 – Net Profit -48%)

Stellantis said it “intends to cancel the common shares acquired through its €3 billion Share Buyback Program apart from a portion of up to €0.5 billion, which will be utilized to execute future employee stock purchase plan activities and equity-based compensation. This is intended to support the benefits of expanding and strengthening the ownership culture inside Stellantis, while avoiding dilution of existing shareholders.” Continue reading →