Master bargaining between Unifor and General Motors opened today for Local 88 members employed at the CAMI Assembly plant and Battery Assembly facility in Ingersoll, Ontario. Negotiations at CAMI follow the union’s 2023 bargaining with Ford, General Motors and Stellantis on behalf of 20,000 Detroit Three members, where the pattern agreement was set.* As a result of the different bargaining cycle there is a significant, ongoing delay before CAMI workers receive the same pay as their counterparts at other GM locations.

“Our members at CAMI are on the frontline of the EV transition in Canada, and Unifor will fight to protect the good union jobs and secure future every autoworker was promised,” said Unifor National President Lana Payne. “These negotiations will focus squarely on securing workers the economic stability our members deserve and that includes aligning CAMI workers with the rest of our GM membership to eliminate the historical lag in wage increases and other negotiated benefits.” Continue reading

Manheim – U.S. Wholesale Used Vehicle Prices Up In August

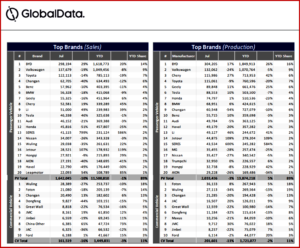

Click to Enlarge.

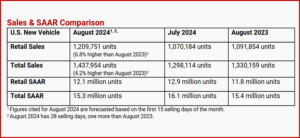

Wholesale used-vehicle prices* were higher in August compared to July. The Manheim Used Vehicle Value Index (MUVVI)** rose to 203.9, a decline of 3.9% from a year ago. The seasonal adjustment to the index mitigated the impact on the month, resulting in values that rose 1.2% month over month. The non-adjusted price in August increased by 2.2% compared to July, moving the unadjusted average price down 4.6% year over year. The data are from the Manheim Market Report (MMR) from Cox Automotive.*** New-vehicle sales in August were up 7.6% from last year, and volume increased 11.2% from July. The August seasonally adjusted annual rate (SAAR), came in at 15.1 million, down 0.2 million from last year’s pace and lower than July’s 15.8 million.

“The trend of higher wholesale values at Manheim continued into August from July, as we saw prices appreciate every week except the last,” said Jeremy Robb, senior director of Economic and Industry Insights at Cox Automotive. “Sales conversion continued to rise and held at much higher levels than prior years for the month as more buyers came to markets to replenish supply for used retail inventory. We know lease maturities are on the decline, and used retail days’ supply has tightened over the last month. That will likely keep pressure on buyers at Manheim in the next several weeks.” Continue reading →