GM said this week in an English-like language that its next-generation hands-free driver assist system, Ultra Cruise (originally Super Cruise#), will be powered by a system-on-chips developed by American semiconductor company Qualcomm Technologies. GM will be the first company to use the Qualcomm Technologies’ Snapdragon Ride platform for advanced driver assistance technology, which has what is claimed as an industry-leading 5-nanometer Snapdragon SA8540P SoC and SA9000P artificial intelligence accelerator. (AutoInformed.com: Autonomous Vehicle Nod – Super Cruise on All Cadillacs)

In Silicon Valley geek speak: “The Ultra Cruise compute is comprised of two Snapdragon SA8540P SoCs and one SA9000P AI accelerator to deliver key low-latency control functions on 16-core CPUs and high-performance AI compute of more than 300 Tera Operations Per Second for camera, radar and lidar processing. The Snapdragon SoCs are designed with 5nm process technology, enabling superior performance and power efficiency. The Snapdragon SA8540P SoCs will provide the necessary bandwidth for Ultra Cruise’s sensing, perception, planning, localization, mapping and driver monitoring.” Continue reading

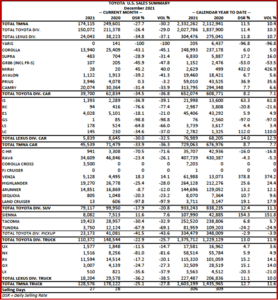

First Place! Toyota Ousts GM as US Sales End 2021 at 14.9m

Click to enlarge.

General Motors’ light-vehicle sales during 2021 fell more than those of any other automaker. GM also suffered the ignominy of ceding its top selling position for the first time in more than 80 years, as Toyota outsold GM for the first time in automotive history. In other changes of fortune, Hyundai sold more than Honda, and Tesla was the fastest-growing OEM. SUVs reached a record 55% share in 2021, according to the respected LMC Automotive consultancy. AutoInformed notes that in the rigged for the rich US economy, luxury vehicle sales clearly outran the broader market.

Overall, US Light Vehicle sales in December fell by 27% YoY, ending a chaotic 2021 at 14.9 million units. LMC noted that even December – traditionally one of the strongest months of the year – flopped and registered the steepest YoY decline of the calendar. The rate of change in the Covid infected world is increasingly making traditional long-term based indexes – such as calendar years irrelevant, or even downright harmful indicators for policy makers, businesses and anyone who uses them for planning. Continue reading →