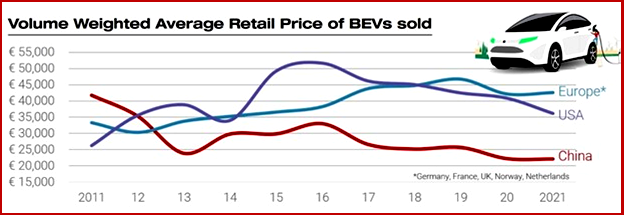

The JATO Dynamics consultancy is building on its considerable knowledge of the industry with the release today of its data looking at the impact of government incentives on the electric vehicle (EV) market during the past decade. In so doing JATO prompts a realization at AutoInformed that China has the lead here.

The JATO Dynamics consultancy is building on its considerable knowledge of the industry with the release today of its data looking at the impact of government incentives on the electric vehicle (EV) market during the past decade. In so doing JATO prompts a realization at AutoInformed that China has the lead here.

This of course is not good news for occidental auto conglomerates or their customers, which through a forced combination of government regulation, shareholder pressure and consumer sentiment are investing billions in EVs to solve the very real and deadly problem of fossil fuel use, which has increasingly visible negative health and climate effects. (Mazda MX-30 EV Starts at $33,470 in CA this October; BMW Group Sales Up for First Half of 2021. EV Sales Surge; EU Gets Tougher on Climate Change – Wants All EVs by 2035)

August Global Light Vehicle Sales Weaken Again

Click to Enlarge

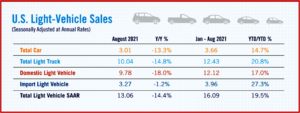

The Global Light Vehicle (LV) selling rate was 82 mn units/year in July, prolonging the weaker trend seen in recent months. The semiconductor shortage held back the post-lockdown recovery of vehicle sales in Europe, while its impact on inventories in the US meant average transaction prices rocketed, according to the LMC Automotive Consultancy. Worse, rising Delta variant cases threaten to impair the outlook in parts of Asia.

The US Light Vehicle market continued to be hurt by low inventories during July. Sales grew by only 3.2% YoY, to 1.28 mn units. This is a slight advance compared to July 2020’s pandemic-affected result. The selling rate declined more to 14.6 mn units/year, from 15.4 mn units/year in June. This is the lowest rate since June 2020. Continue reading →