The Western Europe passenger car selling rate fell slightly to 12 million units a year in January, according to numbers just released by the respected GlobalData* consultancy, at 901,000 vehicle registrations. Year-over-year (YoY) January grew 10.7% with strong growth in Germany and other major West European countries. However, relative to pre-pandemic January 2019, the passenger vehicle (PV) market is down almost 19%.

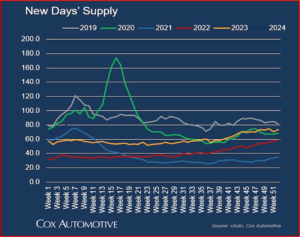

“With supply having been a key limiting factor over recent years, 2024 will see the focus return to the health of underlying demand. In this regard, consumers face headwinds such as high interest rates, inflation, and elevated vehicle pricing. However, the latter should ease as a function of greater vehicle supply and further volume recovery is baked into the 2024 outlook. Risks remains, noting the recent Red Sea attacks hitting freight costs, which only increases pressure on the manufacturing cost base,” the GlobalData European Light Vehicle Sales Forecasting Team said. Continue reading

Stellantis Increases January European Sales and Market Share

Click to enlarge.

Stellantis (NYSE: STLA) said today that in the EU29 market it posted a 7.6% increase in passenger car and commercial vehicle volumes (PC+CV) year-on-year, corresponding to a market share of 19.7%, up 0.9 percentage points compared to one year ago.

“Stellantis’ sales growth across key markets in January reflects our collective dedication to innovation and customer satisfaction,” said Uwe Hochgeschurtz, Stellantis Chief Operating Officer, Enlarged Europe. “This performance, both in volumes and market share across all energies and segments, reaffirms our position as the unrivaled challenger for the #1 spot in Europe. Continue reading →