Owners are experiencing lower levels of vehicle dependability after three years, according to the J.D. Power 2024 U.S. Vehicle Dependability StudySM released today. The large number of tech-ache problems owners face indicate a decline in long-term vehicle dependability, with increased levels of problems reported for nearly two-thirds of brands in the study. The industry average has increased 4 problems per 100 vehicles (PP100) year-over-year to 190 PP100 from 2023. The rate at which problems have increased between 90 days and three years of ownership has increased to 17%, up 5 percentage points from 12% in 2023.

“Historically, VDS model results mirror the results of the respective model year in the J.D. Power Initial Quality Study, so a deterioration of vehicle dependability is unusual,” said Frank Hanley, senior director of auto benchmarking at J.D. Power. Continue reading

European Passenger Car Sales Soft in January 2024

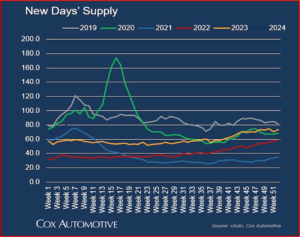

The Western Europe passenger car selling rate fell slightly to 12 million units a year in January, according to numbers just released by the respected GlobalData* consultancy, at 901,000 vehicle registrations. Year-over-year (YoY) January grew 10.7% with strong growth in Germany and other major West European countries. However, relative to pre-pandemic January 2019, the passenger vehicle (PV) market is down almost 19%.

“With supply having been a key limiting factor over recent years, 2024 will see the focus return to the health of underlying demand. In this regard, consumers face headwinds such as high interest rates, inflation, and elevated vehicle pricing. However, the latter should ease as a function of greater vehicle supply and further volume recovery is baked into the 2024 outlook. Risks remains, noting the recent Red Sea attacks hitting freight costs, which only increases pressure on the manufacturing cost base,” the GlobalData European Light Vehicle Sales Forecasting Team said. Continue reading →