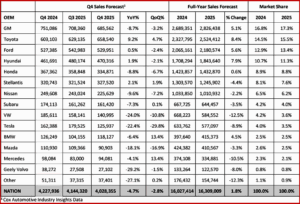

December new-vehicle sales are expected to finish down from last year, but the pace should pick up slightly from previous months and help push total new-vehicle sales in 2025 above year-ago levels, according to the Cox Automotive forecast.* The December seasonally adjusted annual rate of sales (SAAR) is expected to finish near 15.9 million, down from last year’s 16.8 million pace but up from November’s 15.6 million level. Sales volume in December is expected to fall 3.5% from last December. The calendar year 2025 was defined by instability as Trump administration policies fueled insecurity in the automotive market, causing sales to fluctuate sharply.**

“Despite challenges, 2025 has been a good year for new-vehicle sales,” said Charlie Chesbrough, senior economist at Cox Automotive. “The fourth quarter is showing the expected slowdown, as headwinds from tariffs, inflation and reduced EV incentives weigh on the market after nine surprisingly strong months. Still, consumer demand has kept the new-vehicle market healthy throughout 2025.”** Continue reading

November 2025 UK Vehicle Production Plunges

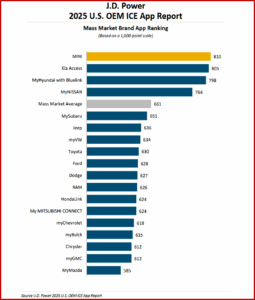

Click to enlarge.

UK vehicle production* fell by -14.3% in November with 65,932 units leaving factory lines, according to data published today by the Society of Motor Manufacturers and Traders (SMMT).** The decline was the result of a slight reduction in car output, down -1.7% to 63,126 units, and a much steeper -78.0% drop in commercial vehicle (CV) output, with just 2806 units produced – 9943 fewer than in the same month last year.

“Car production is normalizing following August’s cyber incident and, with the manufacture of a new EV model starting this week in Sunderland, the sector can look forward with some optimism. [read about Britain’s largest auto employer – Jaguar Land Rover Cyber-Attack Effects Ongoing – AutoCrat] Growth is expected next year, with the industry poised to reap the benefits of recent UK government backing – notably new funding, modernized trade deals and efforts to reduce energy costs. The growth this package seeks to create, however, would be undermined if the UK becomes the main unintended victim of new EU local content requirements. We must instead work on a pragmatic and inclusive approach, one which protects and enhances competitiveness across the European automotive ecosystem,” said Mike Hawes, SMMT Chief Executive. Continue reading →